What is UEN?

In Singapore, a Unique Entity Number, also known as UEN is a 9 or 10 character code given to a business or entity operating in the country. It is issued by the Accounting and Corporate Regulatory Authority (ACRA) as an ID unique to the entity. Since 2009, every business, company, or entity in Singapore must have a UEN to be allowed to operate.

The UEN is generated and issued following the successful registration of an entity with ACRA. It is issued free of charge and cannot be changed even when the business changes its name or other corporate details. It can, therefore, be called the standard identification number for entities such as public companies, private organizations, social sector agencies, etc.

Similar to how individuals have their own unique National Registration Identity Card (NRIC) number, entities such as partnerships, companies, and sole proprietorships have their own UEN.

What is SUN aka Special UEN?

The issued UEN by itself is a system-generated code whose details are which a business owner does not have control over. This means, a UEN will automatically be issued to the registered entity upon successful incorporation.

A Special UEN (SUN) on the other hand, gives owners the ability to select a specific preferred UEN number. Whilst the default automatically issued UEN is free, the choice of selecting a SUN on the other hand costs an additional $1,000 for a tier 2 SUN, or $3,000 for a tier 1 SUN.

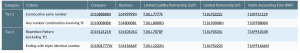

The SUN consists of UENs from a list of reserved codes that you can choose from. SUNs are special in that they contain consecutive numbers, combinations involving the number ‘8’, repetitive number patterns, or ending with triple identical numbers. These features make SUNs memorable and easy to identify with for various entities or entity owners.

Examples of SUN under each tier:

Who are the issuers of UEN?

Being a legally recognized number, the UEN is issued by government-mandated bodies known as UEN Issuance Agencies. These are responsible for the registration of various forms of entities in the country according to their power and capacity. These agencies are such as the Accounting and Corporate Regulatory Authority(ACRA), Ministry of Manpower (MOM), Ministry of Culture Community, and Youth (MCCY), and Registry of Societies (ROS). The following are other government agencies that issues the respective UEN numbers as well.

- The Ministry of Defense

- The Ministry of Health

- The Ministry of Law

- The Singapore Land Authority

- The International Enterprise Singapore

- The Islamic Religious Council of Singapore

- The Ministry of Education

- The Ministry of Communications and Information

- The Ministry of Finance

- The Ministry of National Development

- The Ministry of Foreign Affairs

- The People’s Association

- The Monetary Authority

Who should obtain UEN and who is exempted?

No entity in the country can transact any legal business without being registered and issued with a UEN in Singapore. Entities based in the country such as limited liability partnerships (LLPs), healthcare institutions, businesses and trade unions, as well as representative offices and societies should, therefore, ensure they get registered and issued with a UEN. This is especially important if they engage in regular, continuous, or constant dealings with the government.

However, the following cannot be issued with a UEN;

- Individuals. These are instead required to make use of their national identification numbers.

- Foreign-based entities that have no interaction with government agencies. This includes foreign entities that have had a one-time transaction only.

- Sub entities of a registered Singaporean entity and which can be classified as branches or divisions. However, the mother entity may issue unique entity numbers to these branches but these are not legally recognized and can only be used for internal communication within the entity.

Purpose of a UEN

The main purpose of a UEN is to act as a unique identifier of a business or company. It is useful when interacting with government agencies such as during filing of tax returns, applying for permits such as for export/import business, tendering government contracts, etc. With the UEN, your entity will enjoy a seamless time and cost-saving interaction with the government. This will turn out to be profitable for your business later.

Other than this, the UEN is useful in validating the authenticity of official company documents. This is especially important as since of March 2017 and as stipulated in the Companies Act, a company seal or stamp is not mandatory in authenticating official documents. But with a unique entity number and also coupled with the signature of an authorized staff member, the authenticity of an entity can be established.

Features of a UEN

The UEN is a 9-10 alphanumeric character code unique to every registered business or company in Singapore. The variations occur based on the entity format or type, the year of issuance, as well as the issuance agency.

For all businesses registered with ACRA, the UEN is a 9 digit code formatted as “nnnnnnnnX”. For local companies registered with ACRA as well as all other entities which will be issued with a new UEN, the number is a 10 digit code. These are formatted as “yyyynnnnnX” and “TyyPQnnnX” respectively where:

‘n’ = a number

‘X’ = a check alphabet

‘Tyy’ / ‘Syy’ / ‘yyyy’= year of issuance 3

‘P’= an alphabetical letter

‘Q’ = an alpha-numeric digit

‘PQ’ = Entity-type 2

Can an entity have more than one UEN?

Being a unique identifier, an entity can only have one UEN for its entire period of existence. The entity should, therefore, retain it as it will be necessary to carry out seamless transactions with government agencies or other business to business transactions. Retaining the UEN is also necessary as it saves the trouble and expenses of having to register for a new UEN.

If you suspect that your entity could be having an existing UEN, then you can search with ACRA before applying for a new one. The directory of UENs can be found online on the UEN website or the relevant agency capable of registering your entity. This process can also be used if you needed to find out the UEN of another entity. The UEN search yields details such as the company name, the UEN status, the issuance agency, year of issuance, type of entity, address, etc.